Brenchleys Catering Equipment, Cleaning, Cookware, Glassware, Tableware

FEATURED PRODUCTS

TOP RATED PRODUCTS

-

-

GenWare Polypropylene Round Food Storage Container Lid 2/4 Litre-Discontinued Line – Whilst Stocks Last

£1.04 Excl. VAT188mm (Dia)

-

577-08Y Genware Plastic Handle Buffet Tongs Yellow

£12.46 Excl. VAT24cm Total Length, 18cm Handle Length

BEST SELLING PRODUCTS

LATEST PRODUCTS

-

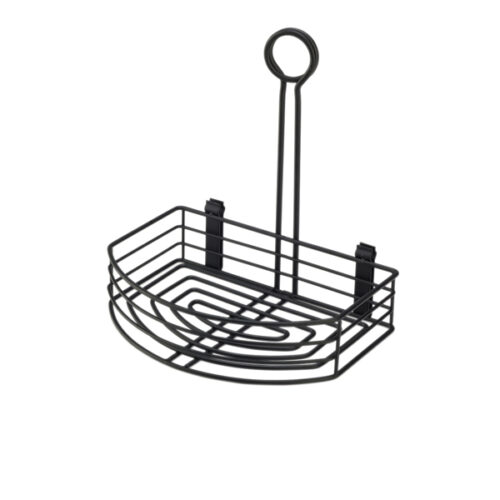

TC86-BK Black Wire Table Caddy 8.5 x 6 x 9 (H)

£13.12 Excl. VATTable Caddy, 21.5 x 15 x 22.5cm (L x W x H)

-

-